Latest News

UK to avoid recession

Britain escaped recession in the first quarter of the year, but only just, according to a respected think-tank.

By Angela Monaghan, Economics Correspondent

The National Institute of Economic and Social Research (NIESR) estimated the economy scraped growth of 0.1pc in the first three months of the year.

If that proves to be the case, the UK avoided dipping back into a technical recession of two successive quarters of economic contraction, following a 0.3pc fall in gross domestic product in the fourth quarter of 2011.

Simon Kirby, senior research fellow at NIESR, said: “Effectively we have avoided a technical recession which is obviously welcome but does not change the view that the economy is flat.

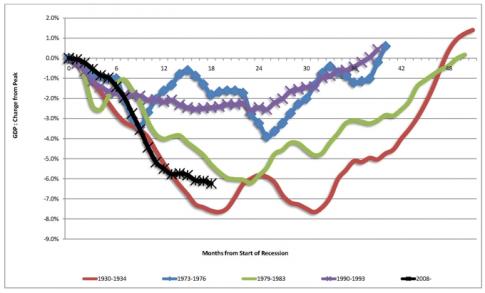

"We cannot get carried away with rates of growth like this. There is still a significant way to go before we enjoy the level of output the UK experienced before the crisis.”

NIESR's figures point to the longest ever economic slump in the UK, but the Bank of England's Monetary Policy Committee on Thursday voted to leave policy unchanged, with no expansion of its £325bn quantitative easing programme. Interest rates were left on hold at 0.5pc. Economists said the MPC might opt for more QE at its May meeting, when its latest round of bond purchases will be complete, and it will have access to the Bank's latest forecasts for growth and inflation.

According to NIESR’s estimates, very modest growth in the first quarter was driven by both public and private sector services output, while the think-tank estimated that industrial production fell by 0.5pc over the period.

Mr Kirby said NIESR had not factored in the potential upside impact from the public’s panic buying of petrol last month, adding it was likely to have a limited effect on overall GDP figures.

Looking ahead to the coming months he said: “The eurozone crisis has not gone away but if it continued [to ease] that would have a positive implication for the UK. Business confidence and investment might start to pick up.

“But there are still some significant headwinds, including a temporary spike in oil prices and the additional bank holiday [for the Queen’s Diamond Jubilee] in the second quarter. It’s 2013 when we think the recovery will really take hold.”

The Office for National Statistics will publish the first official estimate of first quarter growth on April 25.

NIESR revised down its earlier estimate of 0.1pc growth in the three months to February to zero growth, after a weaker-than-expected January.

The fragile state of the UK economy was further underlined by official figures showing a shock fall in manufacturing output in February, which was accounted for in NIESR's latest forecast.

The ONS said output in the sector fell by 1pc over the month, while economists had forecast a 0.1pc rise.

There was further bad news as the ONS revised down its estimate of manufacturing output in January to show a 0.3pc fall and not the 0.1pc increase it initially estimated.

However, the broader measure of industrial production - which includes mining and utilities as well as manufacturing - rose by 0.4pc in February as expected.

Chris Williamson of Markit, said industrial production "should help boost economic growth in the first quarter". Telegraph

Rate this article

del.icio.us

del.icio.us Digg

Digg

Post your comment